As we gear up for an action packed evening in Singapore time, markets are bracing for a series of potentially market-moving events.

Our first event is CPI, with core CPI predicted to come in at 5.6%, higher than the previous reading of 5.5%, and headline CPI expected to come in at 5.1% versus the previous reading of 6.0%.

Although headline CPI is expected to be lower than the previous month, most economists' estimates are at the bottom of the range, however the market expectation is for a higher than expected number.

We are keeping in mind that the Fed is still largely data dependent and has warned against taking its foot off the pedal early. Markets are 75% priced for a 25bps hike in May. Therefore this number carries great importance either way. A lower than expected print will likely take off the hike and lead to a risk asset rally.

Following CPI, FOMC minutes will be released at 6pm UTC. Investors will closely scrutinize the reasons for the Fed's downshifting and what they will keep an eye on in terms of the banking sector, liquidity, and overall market performance. While data dependency on inflation will be a critical factor, comments about bank stability will carry weight, in particular how many rate hikes the Fed see the current credit tightening as being equivalent to.

Lately, crypto as an asset class has not been a good reflection of macro markets. To that end, crypto has its own event risk following the release of FOMC minutes. Shapella is estimated for April 12th 10pm UTC (Epoch 194048).

We fail to see what the bullish case can be for this event as those at the front of the queue are likely to sell spot, while those further back will be hedging via perps/futures if they have not already done so. The market has already seen bearish price action in anticipation of this event, with ETH underperforming BTC in recent weeks.

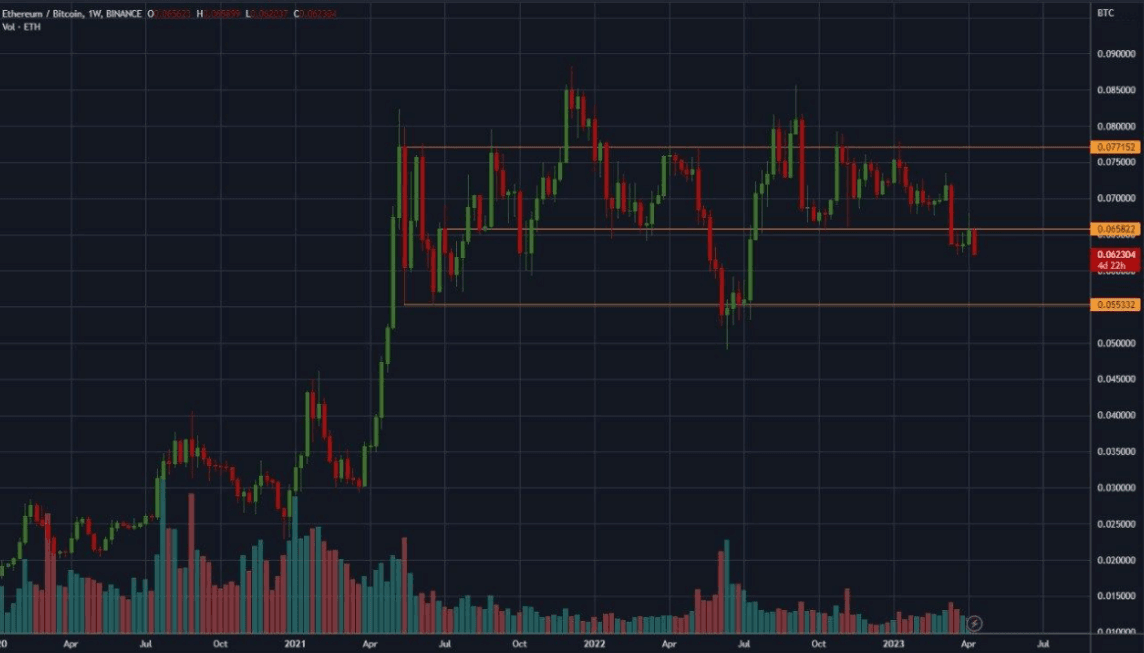

ETHBTC has broken through the key support level of 0.658, and can potentially head back to 0.0553 (Chart below), as continued and sustained spot selling pressure in thin markets for days after Shapella leads to further bearish price action on ETH. This can also potentially drag down the broader market.

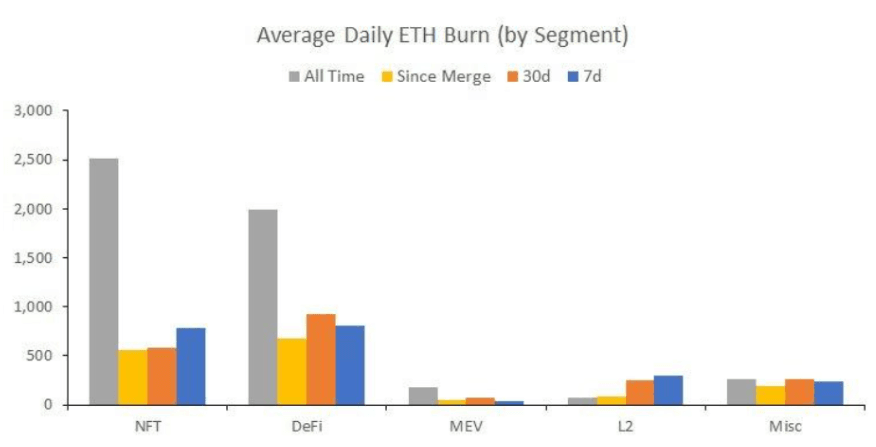

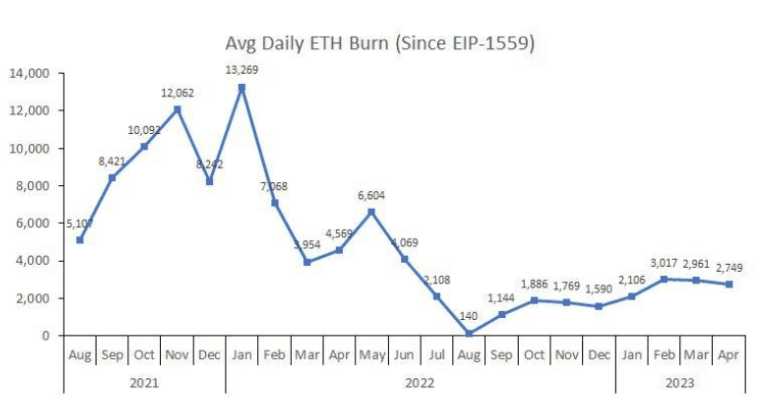

Most importantly, while transaction volumes on the Ethereum network have picked up since FTX's collapse, we have not seen a substantial increase (Chart below) that can rival bull market volumes. As the amount of ETH burnt is linked to transaction volumes, the current low burn rate only marginally supports the bull case for ETH at this point in time (Chart below).

Looking at technicals, ETH is also printing a double top on daily timeframes, after rejecting from 1950 (Chart below).

On the options side, heavy buying flows in calls and call spreads were observed during previous BTC and ETH rallies. However, the recent break towards 30k did not see the same buying activity. In fact, we saw participants taking profit on their call spreads which could possibly signal that participants may be seeing a market top for now.

Furthermore, we are starting to see foundations and miners, who traditionally sell topside, return to the market and add topside supply.