Whilst we have called the major macro events of the past 3 weeks well, it is a tough time for monetisation, with BTC and ETH wedged in such a tight range.

Perhaps Q2 is indeed shaping up to be the quarter of Alts and Airdrops, while BTC takes a breather. Pricing has essentially gone nowhere since 17 March, when BTC closed at 27.5k and ETH at 1.8k.

This is largely due to the huge resistance we are facing in both markets, as highlighted last week. BTC and ETH are also being caught in cross-current narratives at this stage.

However, it has indeed been frustrating watching this narrow 10% high-to-low range hold for near 20 sessions, especially through significant event risk which we had earlier handicapped, and after a 70% move for the quarter.

The range held through the FOMC on 22 March, where we foresaw the Fed hiking 25bp and keeping their 2023 dots unchanged; through the Binance lawsuit on 27 Mar, which we saw as a buying opportunity; and now on the first sign of a recessionary turn in US data last night.

USD and Bond yields, both drivers of BTC, reversed sharply lower last night following the release of the ISM Manufacturing - which showed the sharpest contraction since April 2020 (in the middle of the pandemic).

We expect more weak US data to come out this week, further cementing the recession narrative. After many false dawns, we believe this will indeed be the lasting one.

We previously wrote that BTC as an asset is unproven in a recessionary environment. However, we now add that this is even more so in a stagflationary environment.

If the Fed were to act quickly in a recession, just as they did during last month's banking crisis, we expect that BTC would again moon.

However, in a stagflationary environment, if the Fed feel they are unable to cut rates until inflation has reached their target again, will BTC follow risk assets lower? That remains to be seen.

While BTC is unproven as an inflationary hedge, it is definitely the highest beta monetary irresponsibility hedge out there.

Meanwhile, in the midst of the economic slowdown vs. monetary easing crosscurrents, BTC is playing out in this 10% range, boringly but nicely.

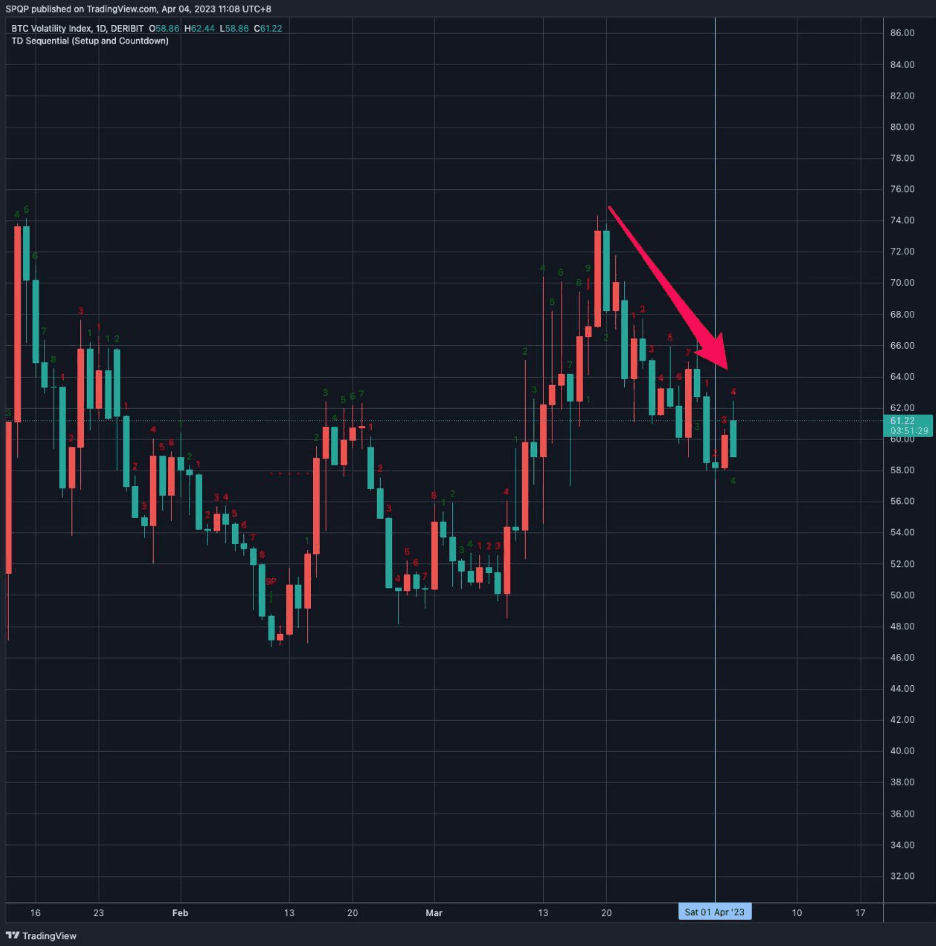

If this range persists, then the action would come in the implied vol markets. Our trade of shorting vol into last week's quarter-end expiry and then reversing long after has worked out well so far (Chart below).

Chart 1: BTC Volatility Index (Deribit)

Chart 1: BTC Volatility Index (Deribit)

From here, we expect vol rallies to be sold on BTC, with perhaps some speculative long vol positions in ETH playing the Shanghai upgrade later this month.

Nonetheless, in the bigger picture, if Q2 does indeed prove to be an Alt-driven quarter, in a replay of 2020, then we expect the best trade would be to fade any sharp vol rallies from here on both BTC or ETH.

If we are really in the replay of 2020, then Q2 consolidation will prove to be a short pause before the uptrend resumes in Q3/Q4. The timing of this will be decided by how quickly the Fed changes course in the face of the rapidly slowing economy.