Mind the Gap

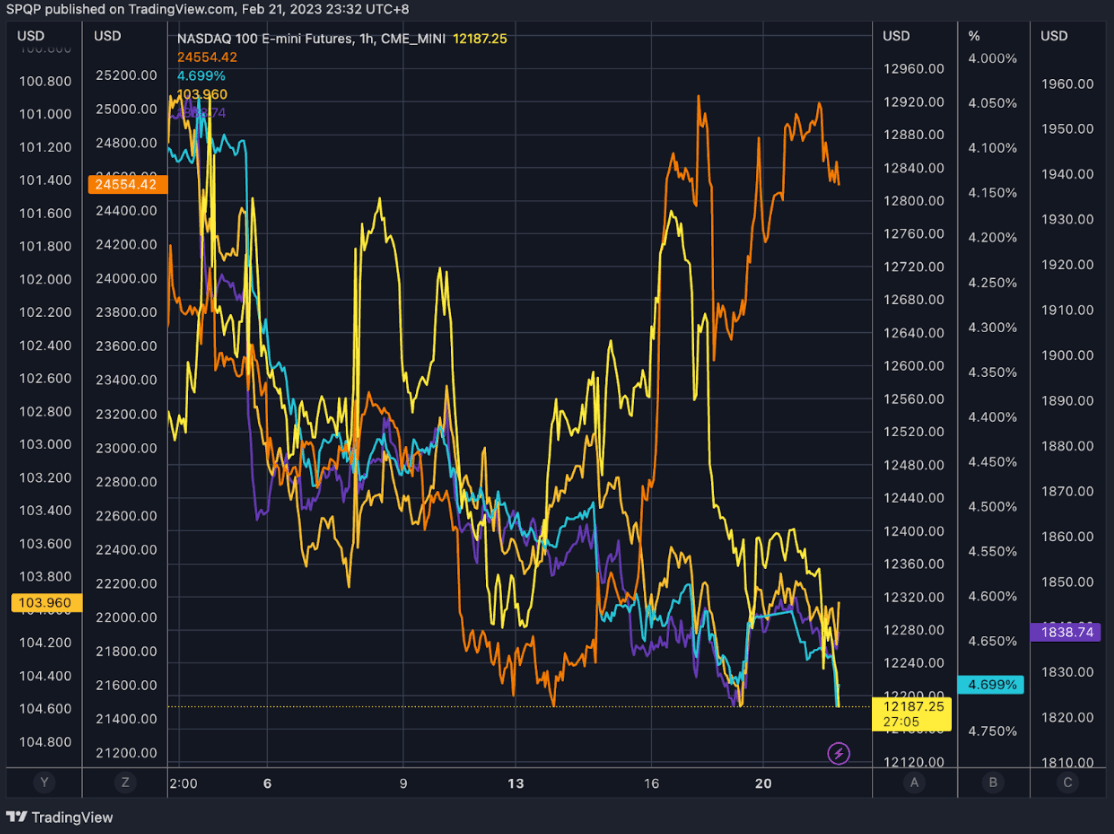

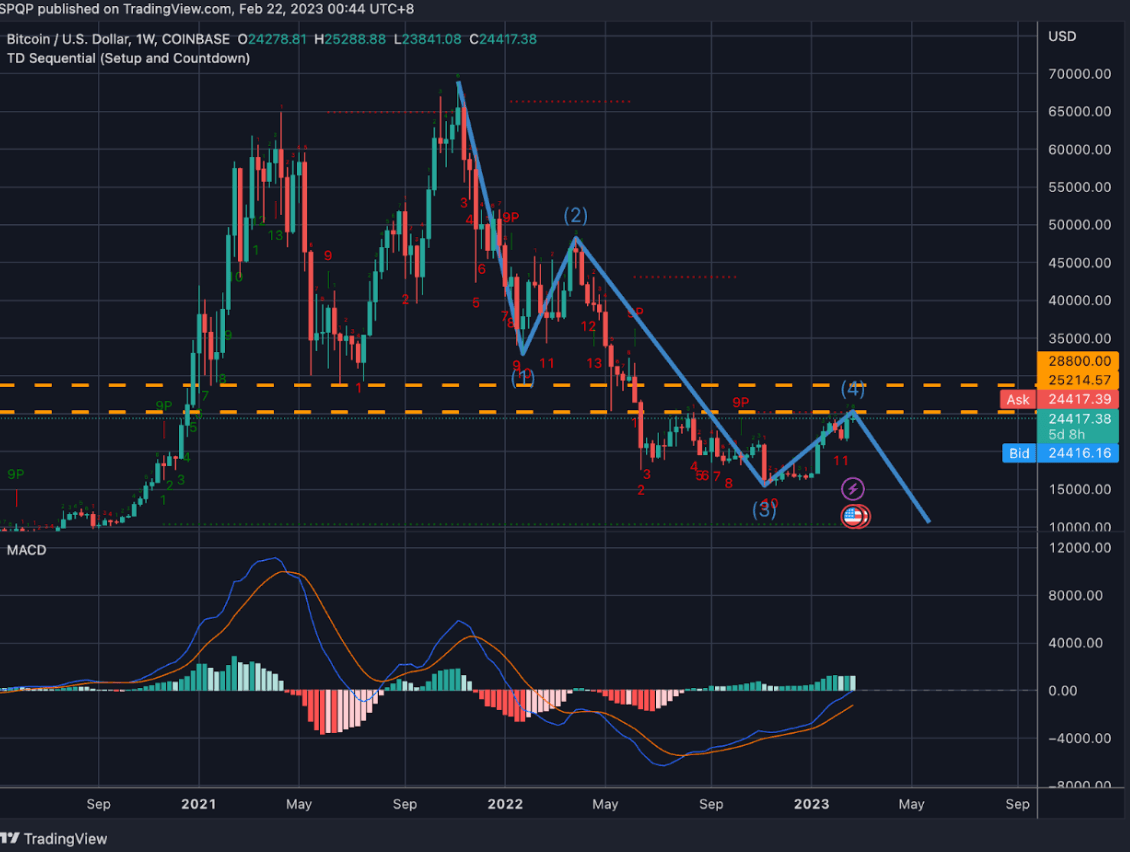

Ever since January’s Crypto Circular, there has been a sharp reversal in almost all benchmark macro markets at or around their 38.2% retracement levels we highlighted. Crypto however, has been the noticeable exception. Since the start of the month, BTC has been admirably bucking the cross-asset selloff in spectacular fashion.

However, we question whether BTC’s resilience is the start of a new bull cycle, or rather akin to Roadrunner’s nemesis Wile E Coyote running off the cliff and not realizing it until he looks down.

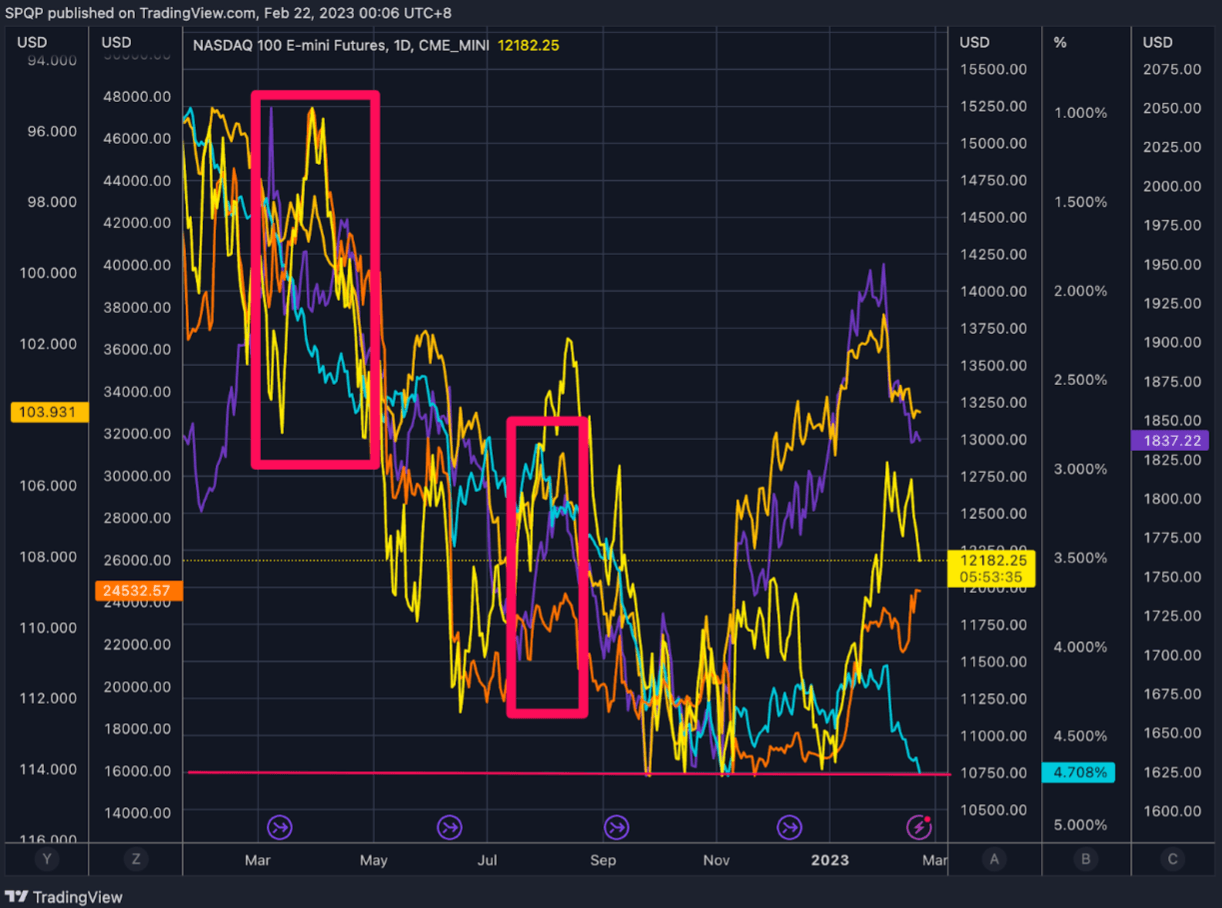

From a longer perspective over the past year, we can see BTC is still playing catch up to the massive 4Q22/1Q23 rally in other markets, which explains its outperformance now.

This is why we wrote on our 6 Feb broadcast that “Although BTC/ETH are our main instruments of trade, we prefer to express our view through a long USD or short Gold position, as we expect crypto to remain more resilient on the way down.”

However, on the two other occasions when yields and risk assets have diverged (March and July 2022), we have quickly seen other assets catch up to the sell-off (red boxes). Having said that, yields have already moved exponentially since this month’s NFP and CPI, and we expect that it will take a breather from here at last year’s high levels (red line).

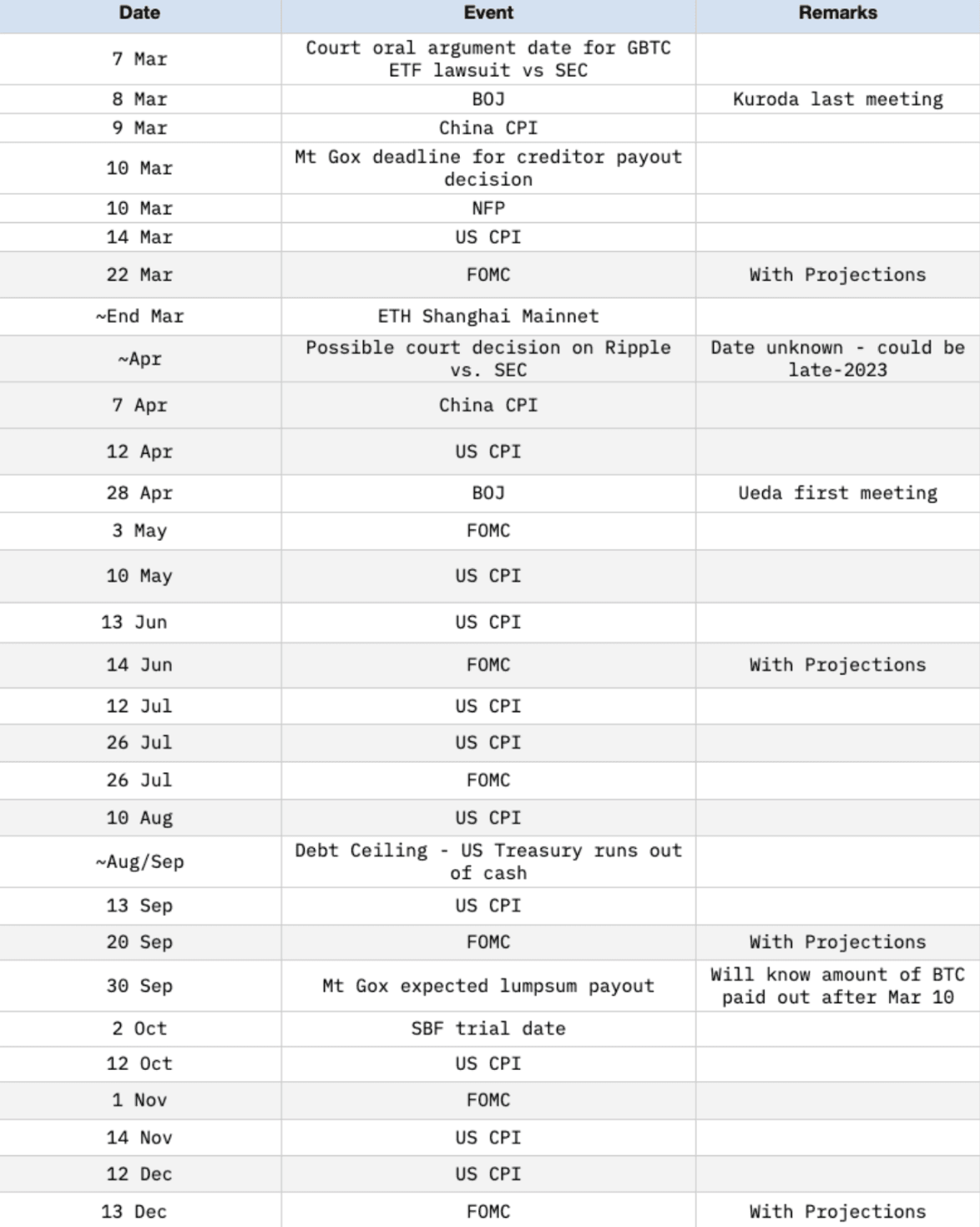

For the break to happen, it would take next month’s set of NFP, CPI and FOMC to back up this move. The market is already pricing a higher rate for 2023 than the Fed’s dots now, which means it would take another strong set of data and the FOMC to move up their median to kick off the next leg lower for risk assets.

Until then, and until the break of these levels, BTC will likely be in a range awaiting its next cue.

What's driving the divergence

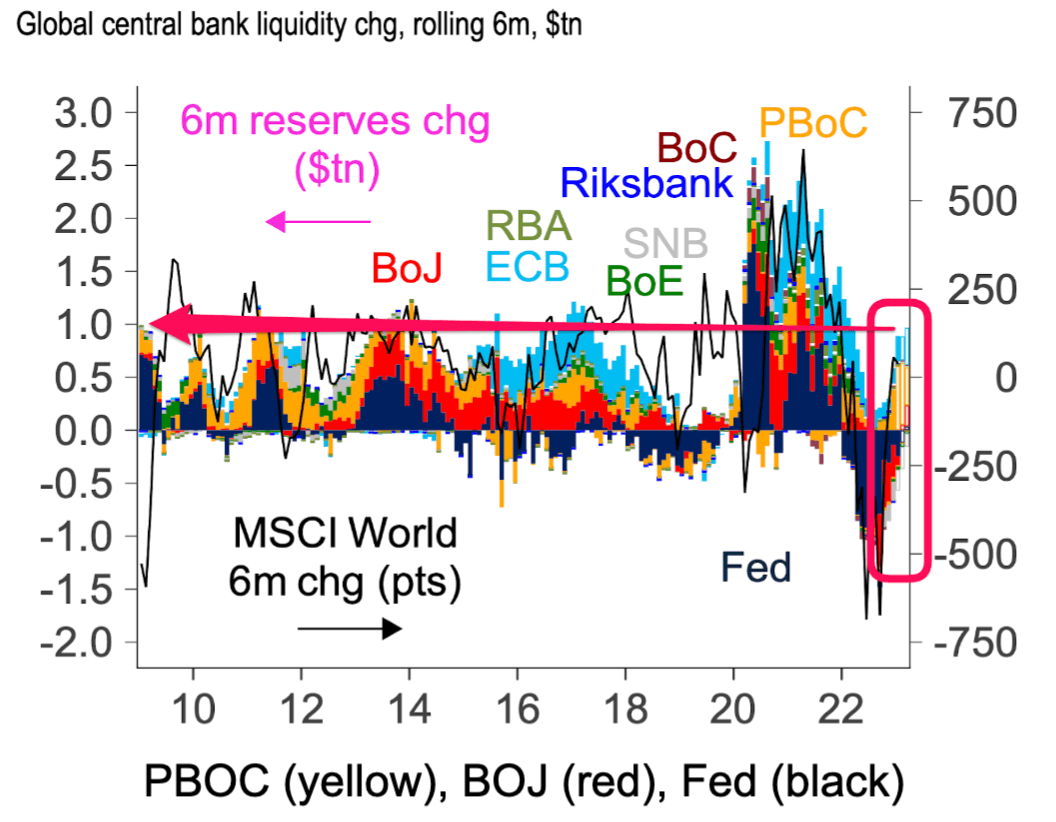

While the jury is out on BTC’s value as an inflation hedge, it cannot be denied that it is the most direct global liquidity proxy, as it is not tied to any one central bank or nation.

And while we were focused on USD liquidity - from the Fed’s QT and Reserve balance, we’ve missed the massive liquidity injection by the Bank of Japan (BOJ) and People’s Bank of China (PBOC) over the past 3 months.

Contrary to consensus, central banks have net added $1 trillion of liquidity since the market’s bottom in October 2022, with the PBOC and BOJ the largest contributors.

Hence, such a large injection of liquidity will no doubt find its way to crypto, even despite what appears to be the current US administration’s best efforts to prevent that.

What we’re watching

What this means is that apart from US data and Fed guidance now, which ultimately still holds the highest beta for market moves, we also have to be conscious of BOJ and PBOC liquidity injections. Any reversal of liquidity from these 2 sources would remove the underlying support that BTC has seen this past month.

In that regard, the next 2 BOJ meetings, which will mark the transition of BOJ governors for the first time in 10 years, will take on added importance even for crypto traders. Along with that, we will be closely watching China’s CPI over the next few months - not as a market moving event in itself, but as a sign of when the PBOC will be forced to slow down its stimulus.

Overall, we continue to believe that the risks are tilted to the downside, as the BOJ and PBOC liquidity injections will have to slow down in Q2, while the Fed’s QT continues at full throttle, with the possibility of an even higher Fed terminal rate to come.

Upcoming 2023 Risk Events

Charts

BTC - A potential double top is forming against the August 2022 correction high, and May 2022 reaction is low at 25,300. Above that we have the huge 28,800-30,000 resistance which is the Head and Shoulders neckline. Until these levels break, our 5 wave count still remains valid, with a final Wave 5 lower to come. BTC momentum continues to be stronger than ETH, as seen from momentum indicators like the MACD here.

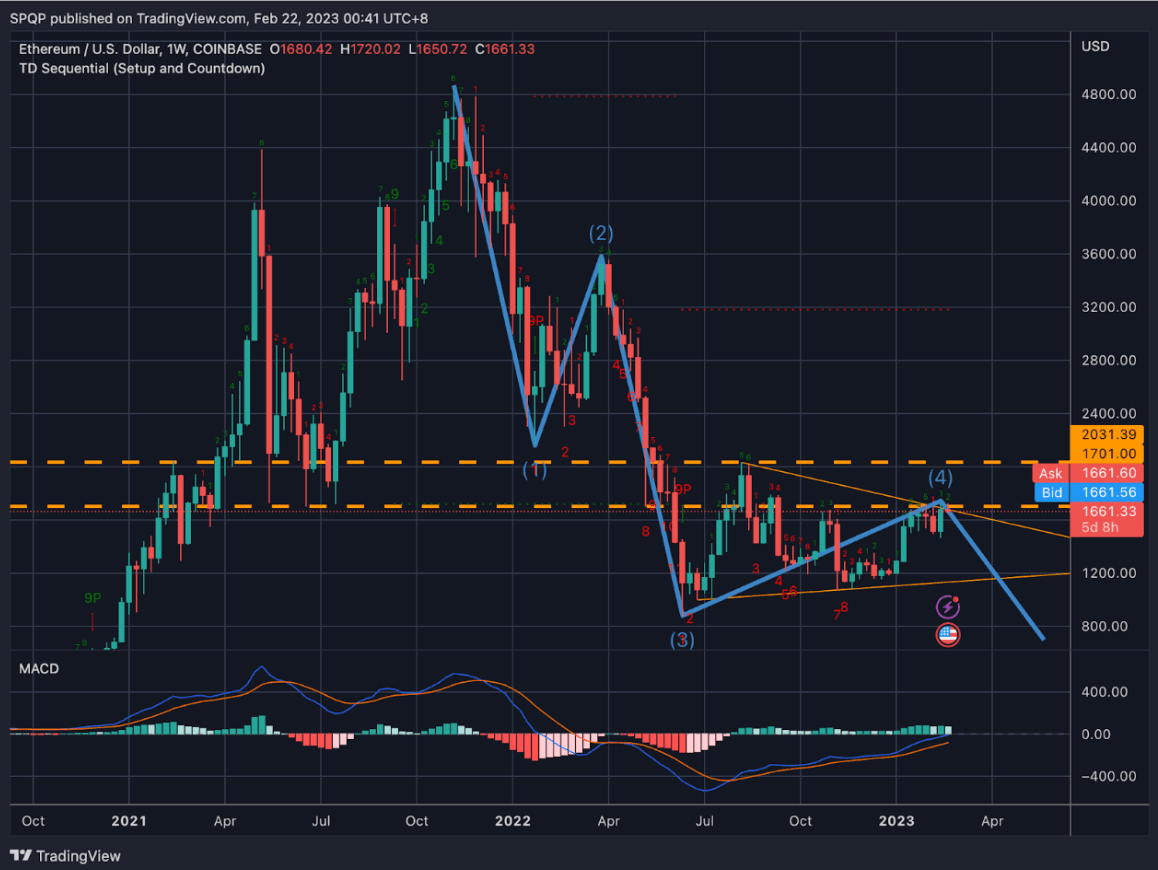

ETH - Still struggling to break the support turned resistance level of 1700-2030, and while we remain under, the final Wave 5 count still remains valid. Our short entry on ETH would be a crossover on the weekly MACD line, possibly after a sell the news following the Shanghai merge.

Disclaimer

"QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019). Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider.

You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.